Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

The Southwest Companion Pass… the holy grail of travel.

If you’re not familiar, the Companion Pass allows the earner to bring someone with them for free on every single flight booked by the holder (provided there’s an available seat). Think of the money you could save by cutting flight prices for two people in half while traveling!

This is normally a “prize” for someone who flies a lot… like a real lot. The qualification is to fly 100 flights (or earn 135,000 points) in a single calendar year. Yikes, that’s a heckuva lot of traveling!!

But here’s the best part – you don’t need to be someone who flies all over the world every week to earn the Southwest Companion Pass. In fact, you can earn this without flying at all. What’s more, you can get it relatively easily just by understanding how it works.

This will be the third time we’ll get the pass and I’m looking forward to it. It’s an awesome asset for saving a lot of money on travel and they make it so easy to use.

Let’s talk about why the Southwest Pass is so valuable, how to get it without much effort, and why now’s the time you want to do it.

How does the Southwest Companion Pass work?

When you earn the Southwest Companion Pass, you’ve earned the privilege to add a companion to every Southwest flight you’ve booked for yourself. The stipulations are that there needs to be another seat available on the flight and you still need to pay taxes and fees on that companion ticket (from $5.60 one-way).

Pretty good deal, right?

You designate an initial companion on the website or through the Southwest app and then you’re allowed to change your companion up to three times per calendar year. That’s pretty generous and presents a fair amount of flexibility for who you can bring on your travels.

Then, whenever you book a flight on Southwest for yourself, you go back into the flight details and just click on the link to add your companion. Simple as pie!

The other important piece of information is that the Southwest Companion Pass is yours for the rest of the calendar year when you earn it plus the entire following year. We’ll talk more about that in a little bit.

You can find more details about the Companion Pass on Southwest’s website.

The problem is that you really need to be an avid traveler to fly the 100 flights or earn the 135,000 necessary points in travel in a single calendar year. So what else can you do?

Getting the Southwest Companion Pass Through Credit Cards

The interesting twist to this is that sign-up bonuses for credit cards also count toward the 135,000 points needed to get the Southwest Companion Pass.

Now, you might look at a typical sign-up bonus for a personal Southwest credit card and see anywhere between 40,000-100,000 points (those rare 100k ones are white whales!). That can be sort of depressing because even a 100k offer still leaves a large gap to make it to 135,000 points.

So typically, what folks will do is start with a personal Southwest credit card and fulfill the spending requirement on the card to get the signup bonus (typically $1,000-5,000 in 3 months, depending on the bonus).

Then, they’ll sign up for one of the Southwest business credit cards to do the same thing. So now you’ve hit TWO signup bonuses to get you over the mark and that beautiful Southwest Companion Pass is all yours to use for the rest of the year plus the entire following year.

Additionally – and this makes it an even better deal – you keep all those Southwest points you earned. So not only are you getting a free flight for someone else, but you can book your own flight for free using the 135,000+ points that you accrued from this. And who doesn’t love free?!!

This is the same path we’ve used to get the Companion Pass twice so far and how we’ll get it this time, too.

I know, I know – you’ve got questions and concerns. Usually, the first one is:

I don’t have a business to sign up for a business credit card. What should I do?

Funny, enough, most folks have what qualifies as a business and don’t even realize it. If you’re doing a side hustle or even just periodically doing something like selling a thing or two on eBay, Facebook Marketplace, or Nextdoor to make a little extra money, that counts. You don’t need to have a formally registered business to qualify.

Most businesses start out as something informal and that’s acceptable. When signing up, just be honest and there’ll be an option to use your social security number instead of a business EIN. Simple as that.

The second question that usually follows is:

Will this hurt my credit score?

When you first apply for a credit card, you will likely get a small ding for the hard inquiry. But once you’re accepted, your credit score will generally go back up and then continue to go up even higher than before you applied. Why? Because you’ve just added more credit to your overall credit which makes your overall utilization go down… and that’s smiled upon!

Bear in mind though that if you close the card later (I always wait until 1 year has passed), you now lose that available credit. And if a card has an annual fee and isn’t as useful to me to pay that fee anymore, I’ll close it after that year mark passes.

However, if you’re on top of your game, you go in with a strategy. When I call to close a credit card, here’s the order I do things:

- The first thing I do is try to get the annual fee waived for another year. If that works, all is good for another year. Done!

- If it doesn’t work, I’ll generally ask them to move my available credit from that card to another one I have at that bank.

- If I don’t have another card at that institution, I’ll ask them to downgrade the card to a card with that bank that doesn’t have an annual fee (if one is available).

- If all of those fail, I close the card.

So, with options 1-3, I keep my available credit and my nice boosted credit score. But, unless the card with the annual fee is extremely valuable to me (like the Capital One Venture X card that I love!), I’ll cancel the card and take the small hit. Keep in mind that this only applies to cards with annual fees. For cards without annual fees, I just leave them in a drawer and pull them out periodically just to put a little activity on them.

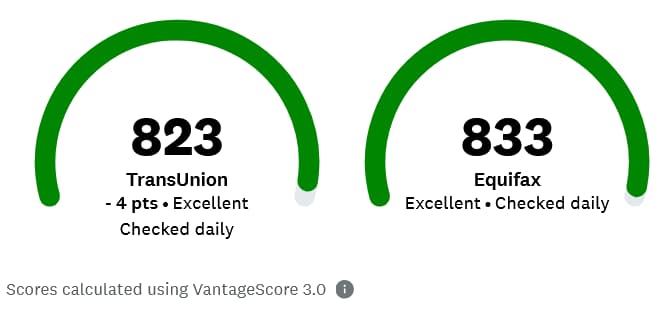

And this strategy has served us well. For example, here are my current scores VantageScores from TransUnion and Equifax:

Not too bad, right? And these are after I just applied for (and was approved for) the Southwest Performance Business card.

By the way, these scores are taken from my Credit Karma dashboard. Credit Karma is fantastic – it’s free and gives you your credit scores and reports anytime you want them (from Transunion and Equifax). It also gives you free credit monitoring and alerts you anytime something odd happens to your credit (inquiries, changes, etc.).

I’m going to take a hard stand to say that, almost without exception, every single person needs to freeze their credit (including your kids!) and should have a form of credit monitoring in place like Credit Karma. All of this is free, folks – you just need to do it!

So back to the Southwest Companion Pass.

The credit card offers change routinely but for the most part, the sign-up bonuses for one personal card and one business card will get you part or all of the way to the 135,000 points. PLUS, the spending you need to do to get the bonuses also counts. So, if you need to spend $5,000 in 3 months to get an 80,000-point sign-up bonus and that’s exactly what you spend, you’ll have earned 85,000 points (5k in spend and 80k for the bonus). And, of course, any Southwest flights you take or doing shopping through their portal, dining rewards, etc. can contribute as well.

Additionally, Southwest card holders now automatically get 10,000 “boost” points each calendar year toward earning the Southwest Companion Pass. This is 10k total regardless of how many cards you have and posts to your account by the end of January.

Are you seeing how straightforward it can be to earn the Companion Pass?

I just applied for and received the Southwest Rapid Rewards Performance Business card last week. The minimum spend for the bonus is a little higher than I like (80,000 points after you spend $5,000 on purchases in the first 3 months). However, this should be doable for us since we’ll pass the card back and forth and use it for all our spending until we meet that minimum spending requirement.

As a side note, the less expensive Premier Business card was only offering a 60k bonus – that’s why I went with the 80k bonus of the more expensive Performance Business card. Of course, I’m looking at it now and the Premier card is now also offering 80k. Ah, such is life! 🙂

As we close in on the spending needed, I’ll apply for the Southwest Rapid Rewards Priority Credit. Right now, the offer is kind of flimsy in terms of points (40,000 points after spending $3,000 in 4 months + a $400 statement credit), but it’ll still work if that doesn’t increase by the time I’m ready to apply.

We’ll have 85k points from the business card (80k sign-up bonus plus the 5k in spending). Then, we’ll get 41k for the second card (40k sign-up bonus plus the 1k in spending). That’s a total of 126,000 points. With the 10k in boost points by the end of January that I mentioned we’ll be good to go!

As a side note, don’t just look at the points and get the cheapest card. For instance, with the personal cards offered, the Southwest Plus card only has a $69 annual fee and has the same sign-up bonus as the Priority card which has a $149 annual fee. However, the Priority card has much better benefits and it also has a $75 travel credit that essentially brings the annual fee down to $74. The Priority card is a better deal overall if you use that $75 travel credit (we will!).

I encourage you to create an account at Travel Freely to help track your credit card rewards and deadlines. It’s an amazing FREE service that also helps you find the right credit cards personalized specifically to you with the best travel rewards. This is what I use and I love it!

Within the Travel Freely site or app, you’ll find the best links to apply for the Southwest credit cards to work your way to the Companion Pass.

Why now’s the best time to go after the Companion Pass

So, what makes now the best time to sign up for the Southwest Companion Pass as opposed to any other time of the year?

Easy. It all has to do with how long you get to use it. Remember, the Companion Pass is good for the remainder of the current calendar year that you earned it plus the entire next year.

So if you earned it in November, for instance, you would have the pass until the rest of the calendar year (maybe 1-2 months) plus the following year.

However, if you earn the pass in January, you’ll maximize your time and have it to use for essentially an entire calendar year plus the entire following year. In other words, you basically get it for two years by earning it at the beginning of the year. That’s a lot of time to reap the benefits and do some much less expensive traveling!

But why start now then and not January? It’s all about the head start… but with some careful planning.

Your points that count toward the Southwest Companion Pass start over at the beginning of each calendar year, so you don’t want your sign-up bonuses to post in the current year. You need them to hit your account sometime after your December statement comes out so that they’ll post in January and count for the 2025 Companion Pass goal.

That’s also why I started with the Southwest Rapid Rewards Performance Business card first. These offers can change at any time, but since the minimum spend for the bonus is $5,000 in the first 3 months, that’s going to take a little bit for our household. We can start now and ensure we get close to that $5k mark without going over. We’ll probably take it to around $4700 at the max to leave a buffer and then stop… until after our December statement posts. Then we’ll be free to spend the remaining $300 to get the sign-up bonus since it won’t post until January.

As we get closer to our $5k spend on that, I’ll apply for the Southwest Rapid Rewards Priority card. That one currently has a $3k spend (though just to repeat, these offers change frequently).

Then there’s the 10,000 boost points that hit at the end of January. That should clinch the Southwest Companion Pass for us, more or less. So that means we’ll then have the Companion Pass available for us to use for almost 2 full years!!

As I mentioned, things might change on the offers – heck, they might even change by the time this post comes out. But regardless, the premise is the same and it’s almost always possible to make this work.

That said, there are some assumptions here:

- You shouldn’t even consider chasing travel rewards like the Southwest Companion Pass if you carry a credit card balance month-to-month. I’ve been there before, really far into that hole actually, and your focus should be on eliminating that albatross before anything else.

- Putting this sort of spending on your credit cards to meet other minimum required spend for the bonus shouldn’t be a burden. We don’t spend any additional money to hit these sign-up bonuses – it’s all just our regular spending and we just focus on putting all of it onto the single card we’re working on at the time.

- Southwest has an airport near you (and you like flying them). If you don’t like Southwest or they don’t fly out of airports near you, maybe this isn’t the best option for you.

- You plan to travel several times in the next year or so. Getting the Southwest Companion Pass wouldn’t be that great of a return for your time and effort if you’re only going to take one or two trips in the next couple of years. You’d probably be better off with a cash-back card instead.

Outside of those, if you love to travel and enjoy flying Southwest, getting the Southwest Companion Pass might be the most amazing deal in travel. We’re stoked to be getting it again as well as to get back to air travel (we didn’t need the pass while spending 8-months of the year on our big RV trip from 2023 to 2024). We’ve got a ridiculous number of vacations we’re planning for 2025 so this should work out extremely well to save us a crazy amount of money!

If you’re interested in following suit with the Southwest credit cards (or any credit cards for that matter), sign up for Travel Freely. It’s a great way to track your credit card rewards, bonus deadlines, annual fees, and to help you find some of the best sign-up bonuses. And did I mention it’s 100% free? I use this exclusively to track our cards and love it.

As an alternative option, I have my refer-a-friend link from Chase. The offers are currently the same as those at Travel Freely. The business cards are offering 80k each as I post this, which is a fantastic deal. The personal cards though are running a little bit of a different promotion right now. They’re offering 40,000 bonus points AND a $400 statement credit after spending $3,000 in the first 4 months. Offer ends 12/9/24.

That’s a hefty bonus worth over $800! It’s hard to go wrong on this one. I still recommend Travel Freely as the go-to, but if that doesn’t interest you, use my referral link for a direct link to the cards.

If you enjoyed this post, consider jumping on the mailing list. I’ll keep you up to speed when new posts come out, talk about some things I don’t discuss here on the blog, and I’ll even send you cool spreadsheet freebies that I think you’ll enjoy…

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.