Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

I retired at the age of 43 at the end of 2018 so I could spend more time with my family and choose how I want to spend each day. It’s been amazing so far and I’m looking forward to the years to come.

Strangely, you need this thing called “money” to be able to pay for your expenses in life. They getcha coming and they getcha going, don’t they?! 😉

Fortunately, we were prepared for that and socked away a fair amount of money that I keep up to date on my Net Worth page. But most of that money was stashed in our old 401(k) plans that have since been rolled into traditional IRAs.

Most folks think you can’t access that money without a penalty until you’re 59½ – you gotta love that arbitrary “½” they add for needless complexity.

The good news though is that a Roth IRA conversion ladder can help you slowly roll your money from your traditional IRA to a Roth IRA. This is a taxable event but can be minimized dramatically with good planning. After 5 years, you can start making Roth IRA withdrawals tax and penalty-free!

I’m not going to dive too deep into a Roth IRA conversion ladder because I’ve already done this before. The post you want to read for that is The Roth Conversion Strategy Guide for Early Retirees. See, I’ve got your back!

However, I’ve run into a point of frustration that I think any early retiree doing a Roth IRA conversion ladder will stumble onto…

How much money from our Roth IRAs can I access right now without penalty?

It sounds straightforward enough. But in reality, you can pull out contributions at any time penalty-free, you have Roth conversions that need to “bake” for 5 years, and then you have to account for distributions you’ve already made.

What’s a guy or gal to do?!

Let’s talk about how this works and how I solved it and made my life a little happier. I’ll even share the solution with you just because I like you guys so much!

Hint: Oh, spreadsheets, how do I love thee… let me count the ways!

Disclaimer: Here’s the disclaimer… I’m just some guy doing what works for me. Consider everything here to be just that – just some thoughts from a guy on the internet. If you don’t completely understand what you’re doing, learn more. Don’t do anything you don’t fully understand without talking to a financial professional first.

Contributions, conversions, and Roth IRA withdrawals… a lot going on

A Roth IRA is a cool account because there’s a lot of what you see is what you get. Unlike a traditional IRA or something like a traditional 401(k) plan, the tax has already been taken out.

When you look at your 401(k) plan, you might think, “Gosh, I’m doing really good here. I’ve got a great nest egg going on!” The problem is that when you move that money out, you still need to pay the tax man so that pot of gold amount you’re looking at isn’t fully accurate.

With a Roth IRA though, it’s funded with after-tax dollars and you don’t get taxed on what you take out. So the amount you see in that account is the amount you can withdraw (outside of market changes to your investments).

So for those of us slowly moving our investments from a traditional IRA to a Roth IRA to fund our early retirement lifestyle through a Roth IRA conversion ladder, that Roth IRA is golden!

But there are a few components to the Roth IRA that need to be kept in mind…

Contributions

Obviously, to have money in a Roth IRA, you need to put money into it first. If you’re still working, the Roth IRA is a great account to take advantage of if you can. The contribution limit isn’t that impressive – for 2024, it’s $7,000 ($8,000 for those 50 and older). But that’s per person so a couple can count on that number twice over and, over time, those accounts can grow.

For years, my wife and I each contributed to our Roth IRAs and we built up a fair amount in our accounts before retiring.

Why is this relevant?

It’s important for one big reason – you can make Roth IRA withdrawals on your contributions at any point in time – tax and penalty-free!

Let’s say you’ve contributed $25,000 over the years to your Roth IRA and the market has helped it grow to $45,000. It doesn’t matter your age or what you’re doing, you can make Roth IRA withdrawals anytime you want up to that $25,000 you put into it. You can’t touch the $20,000 in growth you’ve had without penalty, but the contributions are yours if you need them.

Now, don’t ruin your future retirement because you feel you need a new car, but knowing this piece of information can be extremely valuable in early retirement.

I’ll explain why shortly.

Conversions

For a Roth IRA conversion ladder, you’re moving an amount of money from a pre-tax account like a traditional IRA to a Roth IRA (an after-tax account). This can be done all at once, but that would be one heckuva tax bill so that’s rarely going to be the way to go.

Instead, as an early retiree, your goal is to convert a smaller amount of money every year. That amount will vary based on your circumstances, but in our case, we want to convert a minimum amount to cover our expenses for a year. As far as the max goes, there’s some balance involved. The conversion counts as reportable income by the IRS (it’s a taxable event) so we want to minimize the amount we convert to stay in our preferred tax bracket (that’s the 12% bracket if we can). For others, that might be the 22% or 24% tax bracket – it depends on your plan as a whole.

The other important piece is that we want to balance our conversions with the ACA healthcare subsidies we’re eligible for each year. Convert too much and our subsidies are lowered (remember that the conversions are reported as income). Convert too little and we’re not taking advantage of the low tax rates we’re currently in.

It’s an art for sure and I’m getting better at it. I’ve been using the Personal Finance Bundle from Katherine at Making Your Money Matter for the past few years to test different amounts to convert and it’s worked great. If you’re looking for help in any part of personal finance planning, her Personal Finance Spreadsheet Bundle really is amazing. I wrote more about that in my post, Doing Your Own Taxes and Planning… or Die Trying!.

The point is that even though the conversions take a little effort to plan and do each year, that will be the method to fund our early retirement lifestyle for at least a full year of retirement so it’s well worth it.

But there is one catch…when you do a conversion from an account like a traditional IRA to a Roth IRA, you can’t do any Roth IRA withdrawals on that money yet. I mean, you could, but you’d be hit with a 10% penalty for doing so. Instead, the IRS states that you need to wait for 5 years until that money is reclassified as a contribution.

If, within the 5-year period starting with the first day of your tax year in which you convert an amount from a traditional IRA or roll over an amount from a qualified retirement plan to a Roth IRA, you may have to pay the 10% additional tax on early distributions. You must generally pay the 10% additional tax on any amount attributable to the part of the amount converted or rolled over (the conversion or rollover contribution) that you had to include in income (recapture amount). A separate 5-year period applies to each conversion and rollover. See Ordering Rules for Distributions, later, to determine the recapture amount, if any.

IRS Publication 590-B (2023), Distributions from Individual Retirement Arrangements (IRAs)

These conversions are an extremely important part of financial planning for a lot of early retirees. The Roth IRA conversion ladder allows you to convert money every year to support your lifestyle starting 5 years out.

Important note: The 5-year “baking” period for a conversion to become a contribution means you won’t be able to touch your first conversion until 5 years later. Because of that, you need to have enough saved up outside of that to support your early retirement lifestyle for those first 5 years.

And remember what I said earlier about contributions? Yup, you can withdraw those at any time you want with no penalty (and no taxes because you used post-tax dollars to fund the account). So you could possibly consider using some of your contributions as part of the money to cover you for a portion of those first five years.

Roth IRA withdrawals

The last component we need to mention is Roth IRA withdrawals. This is the best part because the money you had put away in your retirement accounts over the years can now become the money you use to buy your freedom and live your life.

When you do Roth IRA withdrawals as an early retiree, you’re essentially taking advantage of the benefit of Roth IRAs allowing you to take out your contributions. Whether those contributions are money you directly contributed to the Roth or the result of a Roth IRA conversion that’s been able to sit for the 5-year requirement, it doesn’t matter. Those dollars can now be the basis for your Roth IRA withdrawals.

Easy enough, right?

The problem: How do you know the amount of Roth money available to you now?

We’re in our 6th year of early retirement and I’ve been converting money each year from our traditional IRAs. We’re also fortunate that we still have enough money in our taxable brokerage account to carry us for another year or maybe even two. That means we don’t need to do Roth IRA withdrawals just yet.

However, it’s still something I need to be on top of and know what’s available to us every year in our Roth IRA… and therein lies the problem.

Although I keep track of the conversions we’ve been doing, that’s only one part of what’s available to us. We need to take into consideration all three components that I discussed:

- Contributions

- Conversions

- Roth IRA withdrawals (Distributions)

Think about this.

The money we’ve used to make direct contributions to our Roth IRAs over the years is gravy. This is money that we have available to us any time we want. But how much did we contribute? We’ve been funding these accounts for over 20 years and they moved from Ameritrade to TD Ameritrade and finally to Vanguard. In other words, since the accounts didn’t originate at Vanguard, I can’t just do a report of all the contributions – they don’t track the information from before the move. That means I need to figure it out and document all this somewhere manually.

As far as the conversions, we’re moving a minimum amount of money over to cover our lifestyle for a year, but more when possible to take advantage of the low tax rates right now. In other words, it’s not necessarily a “this amount I moved in 2019 will be for 2024, this amount I moved in 2020 will be for 2025, etc.” There will be variances that need to be kept track of with leftovers. It’s also possible that there will be underages at some point in these conversions – maybe we made some good income for a year in a side hustle so converted less that year, for example.

Those differences will need to be accounted for and tracked. Plus, the 5-year amount of time needs to be tracked. Just because the money has been converted doesn’t mean it’s available yet. That adds a little complexity to things.

And finally, there are the Roth IRA withdrawals themselves. Even if I had a total amount of money that I know we can pull as needed from our Roth IRAs, I need to be able to track the Roth IRA withdrawals to know how much I now have left.

So the problem is that there isn’t a good way to track the money that can be withdrawn without penalties at any given time from your Roth IRAs.

If only there was a guy in this exact scenario who could come up with a solution to handle this problem…

.

..

…

….

…..

Ahem, I said, “If only there was a guy in this exact scenario who could come up with a solution to handle this problem…”

Sharing the love… the “Roth IRA Funds Available Now” spreadsheet

Oh, yeah – sorry, that’s me!

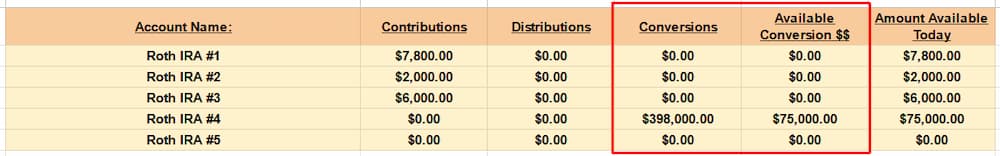

So I obviously wanted a way to handle these problems. I just needed something that could easily tell me how much money I have available to withdraw penalty-free at this present moment in each of our Roth IRA accounts (I have two and my wife has one) and as a whole.

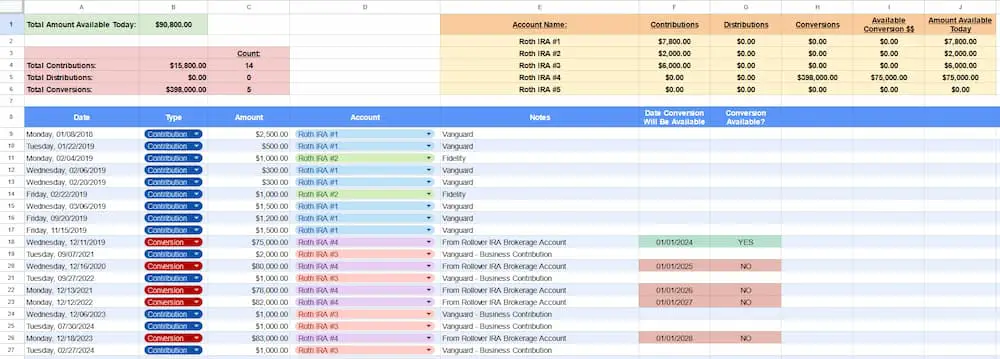

As always, I underappreciated what would be involved in making it a reality, but it doesn’t matter – it’s done. So, I’d like to present you with the Roth IRA Funds Available Now spreadsheet…

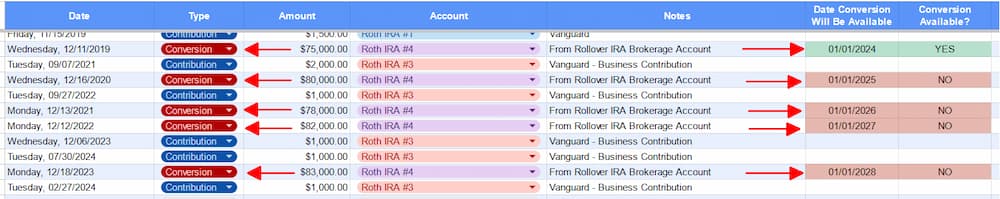

As a side note, this is all sample data. For privacy reasons, I didn’t use my actual information.

I like this spreadsheet because it’s simple. You put in some relevant info and then get the information you need without the headache of figuring it out yourself.

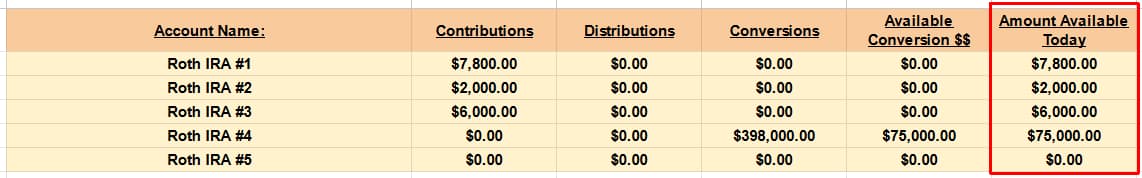

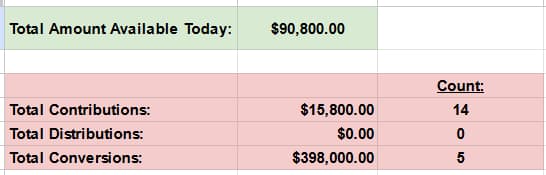

It presents you with exactly the amount you can pull out of each Roth IRA free of taxes and penalties right this moment:

And it also tells you some numbers for the Roth IRAs as a whole:

Pretty cool, right?

All you’re doing is inputting your transactions with the date, type of transaction, amount, selecting the correct Roth, and any notes you want. The rest is handled by the spreadsheet…

Roth IRA withdrawals (distributions) and your contributions should be relatively easy. For most folks, there shouldn’t be many of these transactions that need to be entered.

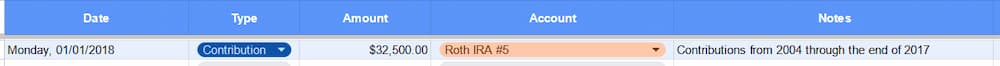

The stickler might be contributions since a lot of us have had regular automated contributions over the years. Personally, I entered each of them individually because I was designing the spreadsheet as I was going. 363 manual contribution transactions… ugh.

However, after getting the spreadsheet completely done, I realized that this can be done insanely easier. Because contributions aren’t date-related and you can take them out at any time, you can just total up all your contributions (your brokerage should be able to give you this information by running a report on their site or giving them a call) and add them in a single entry if desired:

And… done!

Because conversions can be an important component of being able to make Roth IRA withdrawals down the line, knowing when that money is or will be available is critical.

As a side note, the 5-year holding period for a conversion starts at the beginning of the calendar year when the conversion was done. So even if a conversion is done in mid-December of 2024, the start of the clock would still be back on January 1, 2024. That means that those funds would be available starting in January of 2029. That’s a nice bonus, right? It’s also why it can be smart to wait until the end of the year for your conversion so you can see how your finances flowed for the year first.

This spreadsheet lets you know automatically when the money will be available with each conversion entry:

And those funds are automatically totaled for you in the top section as well:

Super cool if I do say so myself! All of this is important and extremely useful information for any early retiree doing Roth IRA conversions.

The best part is that every time you open the spreadsheet, it tells you the information as it pertains to today – no need to change anything. You can always see at a glance exactly where you stand right now.

Plus, once you get the initial info entered, there’s not much upkeep needed. Contributions will likely slow or stop once you’re retired and doing conversions. And entries for conversions or distributions are probably just going to be a few entries per year if that.

I created this for myself, but many of you know that I like to share these things with loyal readers to share the love a little. So, if you’re already on the email list, you should have received a link to the spreadsheet in this morning’s email. If you’re not on the list, stop wasting time and jump on it!

I’ll send you a welcome email with this spreadsheet as well as several others. Look at all these goodies:

- Recurring Expenses Spreadsheet

(discussed in This Bad-@#$ Expenses Spreadsheet is My Gift to You) - Credit Card Rewards Tracker

(discussed in Travel Rewards – 12 Free Flights Earned in 9 Months!) - Portfolio Rebalancing Spreadsheet

(discussed in Portfolio Rebalancing: Get Your Asset Allocation in Line) - HSA Unreimbursed Expenses Tracking Spreadsheet

(discussed in Using Your HSA for Retirement – How to Track It Easily and Efficiently) - Roth IRA Conversion Ladder Calculator

(discussed in The Roth IRA Conversion Ladder Dilemma) - Alcohol Tracker

(discussed in Alcohol Tracking – I Spent Hours Creating This Spreadsheet I Hope to Use Very Little) - Next-Chapter Matrix / Bucket List

(discussed in Creating Your Dream Life: The Ultimate Bucket List Blueprint) - Upcoming Credit Card Bills Tracker

(discussed in My Game-Changing Spreadsheet to Track Upcoming Credit Card Bills) - Roth IRA Funds Available Now

(discussed in Roth IRA Withdrawals for Early Retirees: Tracking What’s Accessible Now)

So hop on and join in on the fun…

Although it did take a little time to create this spreadsheet, it was well worth it. As soon as I open it, I can see how much money we can take out of our Roth IRAs right now as well as know when my conversions will be done with the 5-year waiting period – exactly the info I need to know.

Life is good, my friends!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

Hey Jim, I wanted to get your thoughts on Roth IRA conversions when you have deductible and non-deductible IRA accounts at 2 different firms (Vanguard/Fidelity). Doing some research, it appears there is a complicated pro rata formula that comes into play when you do a conversion. Combine that with the ACA and tax bracket limits, I put Roth IRA conversions on the backburner for now. My current strategy is to spend down these traditional IRAs from ages 60 – 73, the no-penalty, no-RMD, delayed Social Security filing period phase. Does that seem appropriate or am I leaving too much of a good tax break on the table. Key point, I’m just using brokerage money for living expenses until age 60. Thanks

I’m going to be honest, that’s above my pay grade on that. I’ve learned enough about deductible IRAs because that’s my scenario, but I haven’t done enough digging into non-deductible IRAs to know the ins and the outs. That doesn’t sound like fun doing conversions on it. Your plan seems to make sense to me but I also don’t know the rest of your financial picture. Plus, as you know, I don’t have any cool CFP or CPA credentials… so there’s that. You probably don’t want to hear this, but it’s probably well worth the money (maybe even many times over) to pay for a couple hours of a professional’s time to run this by them. On the surface, though, I like your thoughts!

Or you could wait until 60 and know it is all available 😉

Nice spreadsheet. I wonder if the IRS can provide tax data for the years I contributed to the Roth? 40 years of data. If not, how would they challenge my determination of Roth “basis”?

Haha, that’s true, but as someone who’s under 50, that means we’d have to come up with another 10 years of living expenses to tide us over. With the bulk of our wealth is in a traditional IRA (former 401(k)), it’s all going according to plan… excellent [said in a Mr. Smithers from the Simpsons].

That’s an interesting question, but I think “the man” is in the know. The brokerage or financial institution where your Roth IRA is held reports your contributions to the IRS using Form 5498. Don’t know if that form’s been in use for 40 years, but I’m sure they’ve got there eye on all of us! 🙂

Great spreadsheet.

We’ve been fortunate because Mrs. RB40 is still working. She probably will work until she’s 55. At that point, she can access her 401k. The Roth ladder is a great option, but rule of 55 is even better. If you can get the timing right. 🙂

Yeah, the Rule of 55 is really cool. However, I’ve got some friends who were hoping to utilize that but when they talked to the provider, they were informed that it was an all or nothing deal according to the rules of their specific plan. In other words, they would need to pull everything out all at once to get to the money – that would be a HUGE tax hit. I didn’t dig into this myself, but if that’s accurate, it might be worth doing some research into Mrs. RB40’s plan rules just to be on the safe side.

I have been somewhat confused about the relevant 5-year rules. I have had a Roth IRA for more than 5 years. I am over 60. For example, if I converted $25k in 2024 from my traditional IRA to my Roth IRA, it sounds like the $25k would be available for withdrawal at any time without a 10% penalty. Meaning I don’t have to wait for that $25k to “bake” for 5 years to avoid the penalty. Do I understand correctly? Thanks.

Hmm, that’s a great question, Scott, and I have my own thoughts, but I don’t want to put out anything that I’m not confident in. I checked with some of the AI’s out there and got mixed feedback as well. I think that’s a question you’d definitely want to throw out there to a CPA to be on the safe side.