Disclosure: This post contains affiliate links and we may receive a referral fee (at no extra cost to you) if you sign up or purchase products or services mentioned. As an Amazon Associate, I earn from qualifying purchases.

Well, I’ve gone and done it again… I switched personal finance apps in my quest to find the right one for what I needed. I thought PocketGuard was the one, but it turns out I was wrong.

I only used PocketGuard for about 6 months but it had some shortcomings that just didn’t work well for me… so I decided to bail on it.

Fortunately, I think Quicken Simplifi will be the answer I have been looking for all this time.

I don’t think any one solution is perfect for anyone, but Quicken Simplifi fits the bill for what I was after. And so far, it does what I need without those issues I had with PocketGuard. Even though I’ve only been using Quicken Simplifi for a short period, I’m a lot happier with how it works.

What I need in a personal finance app

Loyal readers know that I was an avid Quicken user (now known as Quicken Classic) for years. I started using it back in 1999 while working as a Systems Engineer. It was truly a financial savior to me and provided the direction and motivation I needed to get out of over $30,000 in credit card debt (over $56k in today’s dollars!).

So that software won me over big time. I used it for over 20 years to help manage my finances and there’s no doubt it was a critical tool in my toolbelt toward reaching financial independence. I spent ridiculous amounts of time working in Quicken ironing out the details of our financial plans.

The problem was that it didn’t grow and adapt to the times. Soon there were much nicer apps creeping up into the fintech world that were easier to work with and could run from any browser or even an app on your phone.

Around 2014, I started using the free Empower Dashboard (formerly Personal Capital) to track our investments. That opened my eyes to the notion that there might be other tools out there that could be beneficial to us. For the most part, though, I stuck with what I knew and kept Quicken to manage our daily finances.

However, once I had retired and simplified our finances tremendously, I wanted something I didn’t need to spend so much time working on. I also wanted something I could do from anywhere, including my phone. I didn’t need too much. We’re already frugal with our money so, for us, it’s not overly beneficial to focus on creating and running with a budget.

In all reality, I just needed something easy to track our expenses in. In other words, my goal is to know how much we did spend versus how much we can spend.

I tried switching completely to Empower, but, because we had moved to Panama, we had a lot of cash transactions there and Empower didn’t allow you to enter manual transactions. And, it’s just not a great vehicle for tracking daily spending.

So I turned to Intuit’s Mint app around 2019 to handle our expense tracking. I continued to use Empower for managing our investment side of the equation though because it’s awesome in that regard.

Mint was just ok. It did the job and it was free but it was quirky and it didn’t evolve much. And then Intuit shocked a lot of users by deciding to shut it down this past March.

I did a lot of research (as always) and decided to re-evaluate my needs once again in the process. What I came up with was simple:

- Allow me to connect all my financial institutions

- Allow me to categorize transactions as I want and remember those for future transactions

- Provide good reporting on our spending over each month and each year

- Be available as both web software and an Android app

I later thought about it and added one more very important criterion:

- The service needed to allow me to export my data in a normal format that I could import elsewhere.

I’ve learned over the years that with any software you plan to put a fair amount of time and effort into, you need to think about your exit strategy at the start. You don’t want to be locked into the service later on with your only choice being to start from scratch with an alternative service. So with personal finance software, generally CSV (comma-separated values) files tend to be what they might offer and that works for me.

After evaluating my options, I decided on PocketGuard, migrated all my old Mint data to them, and began using it as my go-to software on 1/1/2024. I thought I had found the right solution.

Why PocketGuard wasn’t right for me

There was a lot to like about PocketGuard when I dug into it late last year. It looked like it checked all the boxes I mentioned above, which was crucial. They ended up getting a lot of new subscribers due to the Mint closure. As a smaller company, the team was eager to continue growing the app.

At the time, they also had a crazy deal going on. While most personal finance software was selling as a monthly or annual subscription, PocketGuard had those plus an option to simply pay a one-time fee to have the software for life. And the fee was only $79.99, which was an absolute steal.

I decided to opt for that one-time cost even though I hadn’t tried out the software. My thinking was that even if it didn’t work well, I’d get some use out of it and $80 wasn’t that much to put on the line. And if I loved it, I’d be one happy camper with that cost!

I wrote more about my initial experience in my post, Why I Chose PocketGuard as the Best Mint Replacement for Me.

It took some getting used to as PocketGuard takes a different approach in that it aims to show you what’s left to spend once your bills are paid. Even though that wasn’t what I was after, that didn’t get in the way too much either.

But then some quirks started rearing their head. The three biggest were:

- The reporting is skimpy and there’s no way to see YTD spending or annual spending for past years. You can only see spending on a monthly basis.

- My Vanguard accounts stopped syncing a few months ago. This is by far the place where most of our money lies. I worked with support and they told me that this was a big problem they’re working on and I just had to wait. Three months later and it’s still not working.

- The monthly expense numbers seemed to always be different between the website and the app even though they’d both be up-to-date. That’s a pretty big deal. Remember, this is the main reason I’m using the software to begin with – I need to know what I’m spending.

Now, things change and these are items that can and likely will be fixed or improved. The team seems eager to keep improving the app so I would imagine that it’ll evolve over time.

However, I can’t just sit and wait for that to happen. I wasn’t happy that I wasn’t getting what I needed from the app. These are pretty important for personal finance software.

I went back to researching and two other services I already knew about previously and still looked to be up my alley kept hitting the top of my list: Monarch Money and Quicken Simplifi (different from Quicken Classic). Both of these seemed intriguing to me previously but I had leaned toward PocketGuard because of that great lifetime price promotion. Monarch and Quicken Simplifi didn’t have those deals so they’d cost quite a bit more over time.

I compared those two religiously and they both met all my criteria from above. The biggest differences were in price and flexibility. Quicken Simplifi is about $48/year and Monarch Money is about $100/year (though they still have a 50% off your first-year promo running). Monarch Money is twice the price but my understanding is that it’s more customizable than Quicken Simplifi.

So I had to make a decision. I’m what you’d call a “power user” and appreciate flexibility in software. However, I’m also pretty thrifty and an extra $50/year is still an extra $50/year every year. Quicken Simplifi does have a 30-day money-back guarantee, but I don’t think that’s enough time to really understand all the nuances of any personal finance app.

After talking it over with Lisa, I decided to give Quicken Simplifi a try. Just like PocketGuard – if it didn’t do what I wanted, I could always change to Monarch Money later and I’d have to eat $48 for the year. But if I had gone to Monarch Money, I wouldn’t ever know if Quicken Simplifi would have sufficed and then I’d probably just continue spending the larger amount of money each year.

So I took the plunge and moved everything to Quicken Simplifi… see, this is why being able to import and export your data within the software is so important! Thank you PocketGuard for allowing me to export everything.

Why Quicken Simplifi is the best personal finance app for me

So here I am now on Quicken Simplifi and I like it quite a bit so far. It’s only been about a month, but the issues I had with PocketGuard aren’t here:

- All my financial accounts are syncing without errors.

- The data matches between the app and the website.

- The reporting is tremendously better.

And please don’t think I’m trying to badmouth PocketGuard. I think those issues will be resolved and it’s actually great software – it just wasn’t for me.

Here’s what I like about Quicken Simplifi…

It supports light and dark mode (I’m a dark mode guy, particularly on my phone):

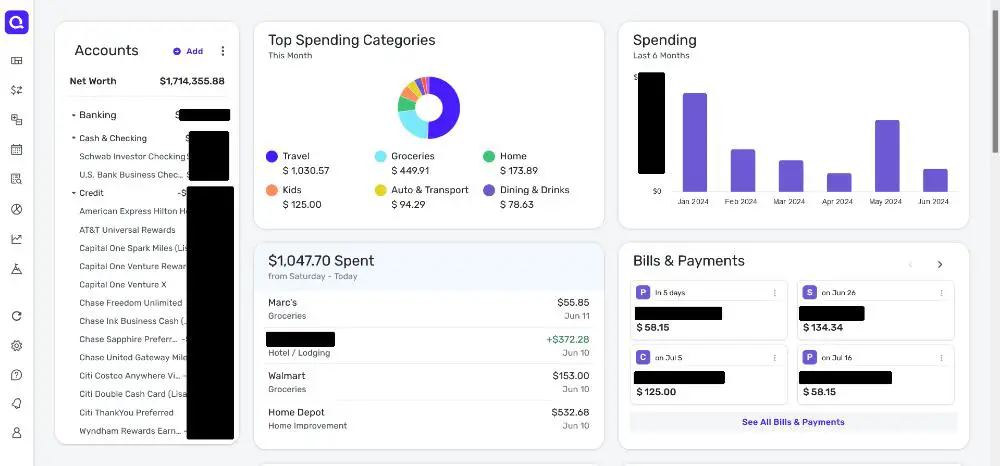

And pay attention to that dashboard above – it’s got great information there with a bunch of other available modules on it:

- Top Spending Categories – This Month

- Spending – Last 6 Months

- $ Spent from Saturday – Today

- Bills & Payments

- Savings Goals

- Spending Plan

- Income

- Spending Watchlist

- Achievements

- Investments

- Credit Score

These can be dragged and dropped on this screen to rearrange to your liking, too. If you noticed, I have the spending modules at the top because that’s my main focus.

Entering or modifying transactions is easy as well…

You can see and work with all transactions or drill down and handle this on a per-account basis. What I really appreciate is that in Mint, you needed to click and open a pop-up window every time you wanted to edit most pieces of info in a transaction. With Quicken Simplifi, you just click in the field, type or select what you need, and then hit Enter or click off it. It’s such a time-saver when modifying several transactions!

Although not one of my main wants for the app, it’s nice that you’ll see your upcoming recurring bills on the dashboard and transaction screens. These can be set up as you go or you can add them on the Bill & Payments screen:

The one feature I do miss from Mint was that it would show you upcoming credit card bills. It knew how much the amount would be and when it was due since it was already connecting to those issuers, so it was nice to see that on the screen.

I’m not sure why more personal finance apps don’t do that but it would be great to have. If you remember, I created an awesome spreadsheet to help track this for me. I discuss that in my post, My Game-Changing Spreadsheet to Track Upcoming Credit Card Bills. And I’ll send that to you for free along with a bunch of other valuable spreadsheet tools just for jumping on my email list…

Did you sign up? Good decision!

Anyway, Quicken Simplifi does a nice job with letting you create and manage rules for payee names and default categories for your transactions so you don’t need to modify these each time new ones come in:

I’m not using this to manage my investments (which I’ll talk about shortly), but Quicken Simplifi does a nice job of incorporating investment information into their app:

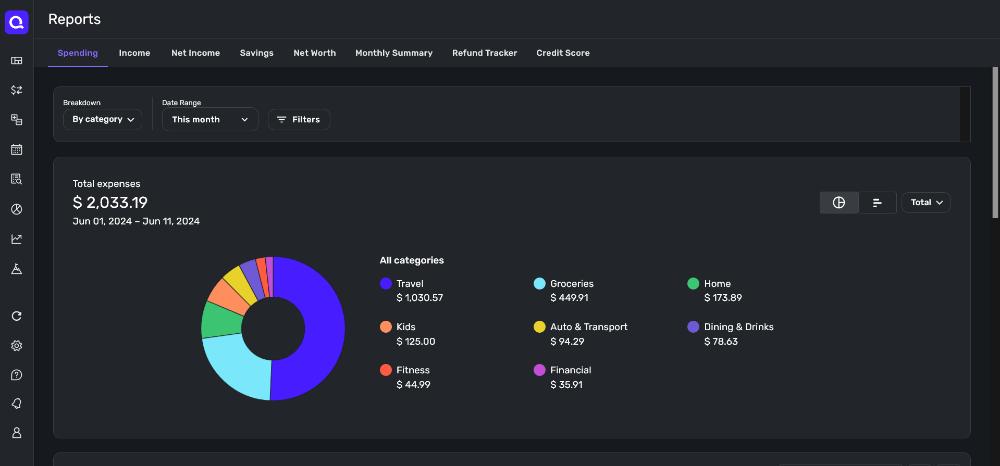

Then there’s the reporting, which is one of the most important aspects of any personal finance software. Simplifi does well on this front giving you some good options and making it easy to see the information needed:

And, just as important, it lets you set date ranges for what you need to review:

To put the icing on the cake, Quicken Simplifi provides the ability to share your data with another person such as your significant other, your accountant, or your financial advisor with their own separate account:

What I don’t like is that this is an all-or-nothing deal. When you share your data, that person gets full access. If I were to give someone access to this data (other than my wife), I don’t want them to be able to modify it – it should be read-only. It looks like I’m not the only one who thinks that though so hopefully that’ll change in the future:

- Read-only user for Simplifi

- Limited Access with Space Sharing

- Ability to select specific accounts to share or not with Space Sharing

And finally, the phone app works smoothly and as it should. It lets you set biometric access to it, too, which should be something anyone does with an app containing sensitive data like this.

Unfortunately, the developers don’t allow screenshots within the Android app so I can’t show you actual shots of what it looks like. I get the balance of security versus convenience but I think a great compromise can be established by allowing a user to toggle the ability to take screenshots for a certain duration within settings. After that amount of time (i.e. 10 minutes), it goes back to locking it down again. Oh, well, such is life, right?

Regardless, know that the app looks and operates almost identically to the website. It’s easy to use and I’m very pleased with it.

And that’s the scoop on Quicken Simplifi, my friend. As I said, I’m still relatively new to it, but it fits the bill perfectly. It’s almost like what Mint could have been if they had put some real effort into it over the last few years. For anyone looking for a Mint replacement, you should find this to be an easy transition with some moments of “wow, this is a lot better than Mint!” along the way.

If you’re interested, you can check out Quicken Simplifi here. Funny enough, it’s some good timing – they have a nice promotion to get it for 50% off with a sale that runs until July 14th. That makes it less than $24 for the year! That’s a much better deal than I got!

I’ll continue to use a different app for my investments though…

Quicken Simplifi has been a great replacement for both Mint and PocketGuard. It definitely alleviated a lot of frustrations I was having with the other apps so that’s a big deal.

That said, I still haven’t found anything as good as the Empower Dashboard for the investment side of the equation, especially considering it’s free.

The site and app are both fantastic and easy to use. The tools within Empower are the real treat though. For instance, with a single click from the menu, you can see your asset allocation:

There aren’t a ton of tools out there that do this. Why is this important? Because for most folks, it’s in your best interest to look at rebalancing your portfolio once or twice a year to avoid exposing you to more risk than you want (or vice versa).

For us, I’m comfortable with our portfolio being around 70-75% equities. So when I use the rebalancing spreadsheet (readers on my mailing list get a copy of this for free) along with Empower’s numbers for my bi-annual check next month, it’ll probably tell me I need to sell off some stocks to get back in line. That’s assuming the market keeps doing what it’s doing!

Here’s one more shot to get on the mailing list…

Then there’s the “Retirement planner” that lets you try different scenarios to see how likely it is that your retirement plan will succeed:

Plus, it has the:

- Withdrawal planner

- Retirement fee analyzer (this saved me over $65k in fees alone over a 10-year period!!)

- Investment checkup

Without a doubt, the free Empower Dashboard is a great tool to keep an eye on your portfolio and use for planning. You can sign up for the Empower Dashboard for free here.

So there you have it. PocketGuard might be a great solution for some, but it just didn’t work for what I wanted. Between using Quicken Simplifi for my day-to-day spending and tracking and using the Empower Dashboard for my investments, I’m set and happy as a lark. Being able to use either of these smoothly and easily from anywhere on the web or from my phone makes it even better.

It’s the little things in life, you know? Ok, considering these are the tools that manage all your money, I guess they’re not little. So I’m glad I now have two that work great for me!

Plan well, take action, and live your best life!

Thanks for reading!!

— Jim

i started using Simplifi at the end of last year, too. My main goal is expense tracking and it works very well for me. I also Ike the app: it makes it easier to adjust some expense categories or split expenses while traveling.

Good luck transitioning back to home life!

Thanks, Olaf! Definitely nice to be able to split on expense categories easily – that seems to be something I need to do at least once a week. I’ve been very happy with how well it handles “remembering” and categorizing expenses, too.

Hi Jim.

I have enjoyed your content for years. I, too, am a long-time Quicken Classic user (since ’96) and it continues to be my primary financial tool for cash management & spending. Almost all my investment accounts are with Fidelity (including using their Cash Mgmt accounts for checking functions) so I use their Full View & retirement planning tools (along with Pralana Gold).

What advantage does Simplifi have over just using Quicken Classic? At first glance, every screen you shared above is available in Classic (although some may have to be configured).

Your comments?

Keep up the good work!

Hi George – thanks for the kind words!

Nothing against Quicken Classic in the least – like I said, that’s the software that helped me figure out how to get out of debt and keep everything in check to reach FI. But now that we’ve been there, I essentially just wanted something that I didn’t need to sit in front of a desktop to do. For instance, when I lay down at night, I can do a quick check of the latest transactions on my phone to mark them as reviewed and call it a day. That was something that Quicken wasn’t good at when I left – they had a mobile app but it wasn’t impressive in the least. Simplifi’s app is great and makes it a cake walk to review/modify/add transactions and the reporting is really good on it, too.

Maybe Quicken’s app has improved over the years but it was really bad when I used it years ago and it just gave you a synced read-only copy of your data. Again, Quicken worked well for me over the years but I didn’t need all those bells and whistles anymore. Simplifi probably doesn’t have everything Quicken does but it does great at what I need it to and at a fair price (and cheaper than Quicken Classic). 🙂

Very informative article Jim. What’s held me back from using these financial consolidator apps is the risk of a hack exposing many accounts. Did es this concern you? Perhaps I’m just a bit paranoid.

In an online world, convenience versus security will always be the balance that each of us needs to decide what we’re comfortable with. For me personally, when it comes to the financial aggregators like many of these apps, I’m ok with them for a few reasons:

Again, these are just my thoughts – everyone needs to do what’s comfortable for them. However, what I gain from being able to pull in all my accounts in one place far exceeds the risk for me.

Hope that helps!